- Analytics

- Trading News

- Is Apple's Dominance Sustainable?

Is Apple's Dominance Sustainable?

Apple remains a dominant force in the consumer technology space, has a loyal customer base, a strong brand, and a diversified product portfolio. However, the company faces challenges from competition, regulatory obstacles, and potential market saturation.

Market Leader with Premium Valuation

Apple's market capitalization is a measure of the total value of all its outstanding stock. At $3.6 trillion, it shows how much investors believe Apple is worth. This high number reflects Apple's strong position in the global market.

Apple's P/E ratio is around 35.87, which shows that investors are willing to pay more for each dollar of Apple's earnings than they typically would for other companies. This suggests investors believe Apple's earnings will grow in the future.

The fact that Apple's stock price is near its highest point in the past year (52-week high) is another sign of investor confidence. A high stock price often indicates that investors are bullish on a company, meaning they expect the price to keep going up․

Innovation Drives Growth

While the iPhone remains a crucial product for Apple, the company is focusing on growing other areas of its business. This is evident in the strong growth of the services segment, which includes things like Apple Pay, iCloud storage, and Apple Music subscriptions. Apple is constantly looking for new ways to innovate and develop new products and technologies.

- The recent release of the M4 chip, which is likely to be used in future Macs and iPads.

- The upcoming Vision Pro AR/VR headset, which suggests Apple is looking to be a leader in the emerging field of augmented reality and virtual reality.

- Potential partnerships with companies like Google for AI technology, which would allow Apple to leverage expertise in a critical area for future devices.

Competition and Regulatory Landscape

- Challenges

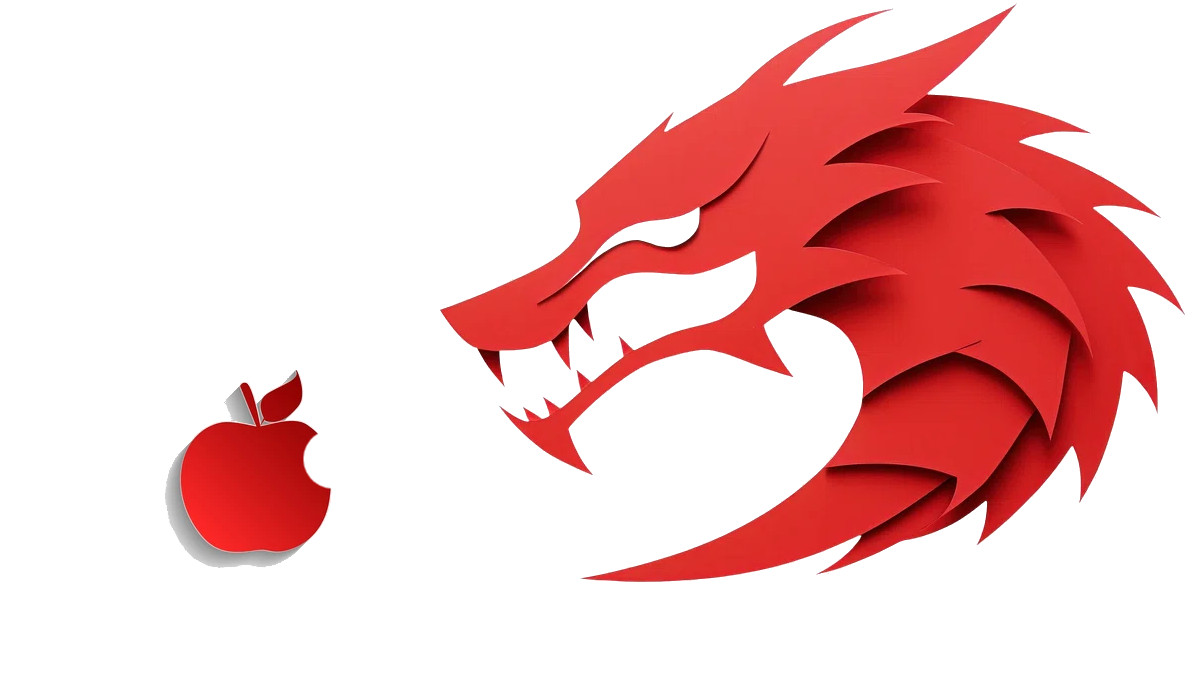

Apple faces strong competition, especially in China, from companies like Huawei and Xiaomi. These companies often offer similar products at lower prices, making it harder for Apple to maintain its market share.

Regulatory bodies around the world are scrutinizing Apple's practices, particularly regarding its App Store. The EU DMA (Digital Markets Act) could force Apple to change how it operates the App Store, potentially affecting its revenue streams.

- Apple's Strategies

Apple invests heavily in research and development to stay ahead of the competition. This allows them to develop new products and technologies that keep customers interested.

Apple is pursuing a two-pronged strategy for artificial intelligence (AI):

- They're working on developing their own AI technologies.

- They're also open to partnering with other companies, like Google in the rumored AI deal, to access cutting-edge AI technology.

Future Outlook and Analyst Projections

- Analysts expect Apple's revenue to keep growing, reaching $388 billion in fiscal year (FY) 2024 and potentially reaching $412 billion in FY 2025. This signifies optimism that Apple will continue to be a successful and profitable company.

- The services segment, which includes things like Apple Pay, iCloud storage, and Apple Music subscriptions, is seen as a key driver of this growth. Analysts believe Apple will continue to generate more revenue from these services, potentially becoming less reliant on iPhone sales for overall growth.

- The potential for on-device AI capabilities is another factor analysts see as driving growth. Imagine having smarter AI features directly on your iPhone or iPad, without needing an internet connection. This could lead to a whole new range of applications and functionalities, making Apple devices even more attractive to consumers.

Analysts are bullish on Apple's future - They expect the company to continue growing its revenue base, driven by a strong services segment and the potential of on-device AI capabilities.

Bear Case vs. Bull Case

Bear Case Concerns

- Vulnerability in China's competitive market.

- Regulatory pressure impacting App Store revenue.

Bull Case Opportunities

- Growth potential in services, especially payments.

- New product innovations like AR/VR and AI advancements driving sales.

Bottom Line

Apple remains a dominant force with a loyal customer base, strong brand, and diversified products. Its high market cap and P/E ratio reflect investor confidence in future growth. While the iPhone is still crucial, the services segment and potential for on-device AI are seen as key growth drivers.

Growth Opportunities

- The strong growth of Apple Pay and other services suggests significant future revenue potential, potentially reducing reliance on iPhone sales.

- The M4 chip, AR/VR headset, and potential AI partnerships showcase Apple's commitment to innovation, which could drive future sales.

- Analysts predict continued revenue growth for Apple, driven by the factors above.

Challenges and Risks

- Companies like Huawei and Xiaomi offer strong competition, particularly in China.

- Scrutiny over the App Store and EU DMA could impact revenue streams.

- Potential saturation in mature product segments could hinder growth.