- IFC Markets 이노베이션

- PCI 적용 관련 기사

- 포트폴리오 거래

Portfolio spread based on continuous futures

In this overview we would like to present the opportunity of creating personal composite instruments, and also the methods of predicting their fluctuations on the basis of technical analysis. Here we consider four CFDs: wheat, cotton, frozen beef and Dow Jones Industrial Index (DJI). We will create the following personal composite instrument PCI GeWorko: portfolio [wheat + cotton] quoted against portfolio [DJI + frozen beef]. The weighting is equal: 25% for each asset. At first, we would like to describe briefly current fundamental trends and events which influence the price fluctuations of the given assets.

Wheat

Wheat futures CFD is traded in USD/100 bushels. Since the year beginning its price has slipped 18%, from early May highs – one third. The main reasons for this are the following: grain inventories sales of Chinese state reserves and the increased world crop forecast in the current season.

1. Sales of stockpiles

According to China Grain Reserves (Sinograin), the level of state wheat stockpiles this year outperformed three times the one of the last year. Moreover, the company purchased 24.34 million tons of a new grain crop from farmers. According to this data, China National Grain and Oils Information Centre expect wheat imports to China to be reduced 57% in 2014/2015, compared to the season earlier. The sales of Chinese state wheat stockpiles, which started early May of 2014, would reach 32 million tons by the end of October, according to Sinograin estimates. Thus, almost half of the stockpile would be sold, which is estimated as 70 million tons by the end of April. We assume that further stockpile reduction is unlikely to happen.

According to China National Grain and Oils Information Centre, the total crop of wheat, corn and rice in China for this year would increase 1.7%, to 552.1 million tons. The domestic consumption surge would be considerably higher, due to the economic slowdown and that would amount to 2%. However, since there was a great volume of stockpiles collected over past years, supposed to be sold, the total imports reduction of the given types of grains would amount to 34.3%, or 11.5 million tons.

In our opinion, inventory sales along with the expectations of imports reduction are the major factors of the recent world grain price-cutting. We deem that this process is temporary and after the aged Chinese stockpiles are sold, the grain prices would be kept stable.

The world crop gain confronts the higher demand amid the global population growth. This is why it is better to compare the changes in world stockpiles. According to Unite States Department of Agriculture (USDA) forecasts, world wheat inventories would increase 196.38 million tons by the end of 2013/2014, from 186.77 million tons (5%) by the end of 2013/2014. The level of the US wheat stockpiles would likely to be considerably higher – 19%. The expected growth in stockpiles had an impact on global prices. However, we still suppose it might be revised downward due to weather conditions.

Weather-chart makers do not leave out the possibility of El Niño hurricane appearance this year: it may become the reason for a drought in several agricultural regions in the world. Historically, this kind of natural disaster appears at least every 3-8 years. Last time El Niño appeared in 2009-2010, subsequently, this fact raises the likelihood of its another forthcoming. More detailed forecasts will be available in a few weeks. Note that a surge in global wheat prices in 2008 was explained by the droughts in China, Kazakhstan, and Ukraine, and subsequently reduced world stockpiles to a level of 110 million tons.

Cotton

A Cotton futures CFD is traded in USD/100 pounds. In the world market it is usually measured in bales: each bale weights 500 pounds or 226.8 kg. The current situation on the world cotton market in many ways coincides with the wheat market. Cotton reserves in China at the end of 2013/2014 season outperformed by 180% the annual consumption volume and reached 45 million bales (10.2 million tons). Thereafter, along with wheat, domestic sales of cotton inventories started in early May. This resulted in fallen world prices by about a third to a five-year low. Accordingly, the stockpile sales caused a sharp reduction in cotton imports to China. It is expected to fall to ten-year low in 2014/2015 and would amount to only 1.3 million tons. In turn, it would cause a surplus of cotton on the world market. And as in case of wheat, we deem that the sales of Chinese stockpiles can be a temporary factor.

According to the USDA outlook, world cotton stockpiles in 2014/2015 would boost 6% compared to 2013/2015 and reach 23.14 million tons. As in case of wheat, we do not rule out the weather impact on the outlook of world crops and inventories. It should be highlighted that in both cases no remarkable increase in cotton and wheat cultivation areas in the world is expected. The production growth is caused by expectations of increased harvesting due to weather conditions.

Beef

Frozen beef futures CFD is traded in dollars per 100 pounds. Unlike the fallen wheat and cotton, meat has risen 45% since the beginning of the year. The US livestock amounted to 95 million at the beginning of the second half of this year, the lowest level since 1973. The US livestock reduced only 3%, compared to 2012, when beef prices were 30% lower as opposed to current prices. We do not rule out the possibility of the livestock increase in the near future, as currently the number of calves is only 2% lower than two years ago. Obviously, beef price hike has already stimulated American farmers to breed cows, but the result will be fully visible in 2015.

According to the USDA, beef production increase this year would amount to modest +0.4%. India would likely to have major gains from the price hike. Its exports are expected to increase from 1.4 million tons in 2012 to 1.9 million tons this year, or 35%.

The overall world beef production may increase 4% this year to 58.86 million tons, from 58.62 million tons in 2013. It is almost twice lower than the demand growth pace of 7% from 56.83 million tons to 57.24 million tons (the difference between supply and demand makes up global beef cattle inventories). In our opinion, this imbalance triggered a rally on the frozen beef market. This year China is planning to increase beef purchases on the world market by almost 16% compared to last year. The imported beef does not play a very significant role in consumption. Its share in the “meat balance” of China is only 3%. It is the fourth largest beef producer in the world after the United States, Brazil and the European Union. For this reason, we accept the possibility that the real volume of frozen beef imports into China may be less than expected due to a substantial price hike. In this case, beef futures would likely to slump.

Dow Jones Industrial Average

This index is considered to be the oldest in the US. It is calculated on the basis of price-weighted average of 30 largest American companies. Now it includes not only industrial companies, so the word “Industrial” serves to honor the history. The total capitalization of companies listed in the index is $4.87 trillion. In mid-September, the Dow hit a historical high, after that it started to dip. Now it is 1.2% below the level of the year beginning.

We accept the possibility that the US stock market should continue to fall as the main US financial event of the year is the completion of the third stage of quantitative easing (QE3). It would be announced at the next Fed meeting on October 29, and becomes the next step in the monetary policy tightening. The actions taken by the American regulator have already affected the currency market and caused strong dollar appreciation, which lasted for 12 weeks. Investors have no doubt that after the QE3 completion, the Fed will begin to rise gradually the rate which now stands at 0.25%. According to the majority of forecasts, it would happen for the first time in July next year. The rate hike would automatically raise the interests on commercial loans, and it would cause an increase in expenses of the US companies. Currently, they spend up to 90% of their profit on dividends or their own stock repurchases, but for business development they use cheap loans. Such a policy caused a strong bull market rally and prices hit new record highs. It should be noted that the rate hike increases the investment attractiveness of the bond market, which will compete with the stock market for raising funds. Dividends of corporations may fall, while bond rates would rise.

Before moving on to the technical part of this overview, we would like to point out that the proposed personal composite instrument [Сotton+Wheat]/[F-Cattle+DJI] is not a rigid scheme to follow, but it rather contains a number of ideas and reasons for further reflection. In theory, you can put corn CFD in the basic part, and replace DJI with S&P500 or NASDAQ in the quoted part. Try different combinations in order to achieve more precise signals for opening a position based on the technical analysis approach. In this overview we will consider the simplest option of a portfolio spread, suggested above.

Technical analysis

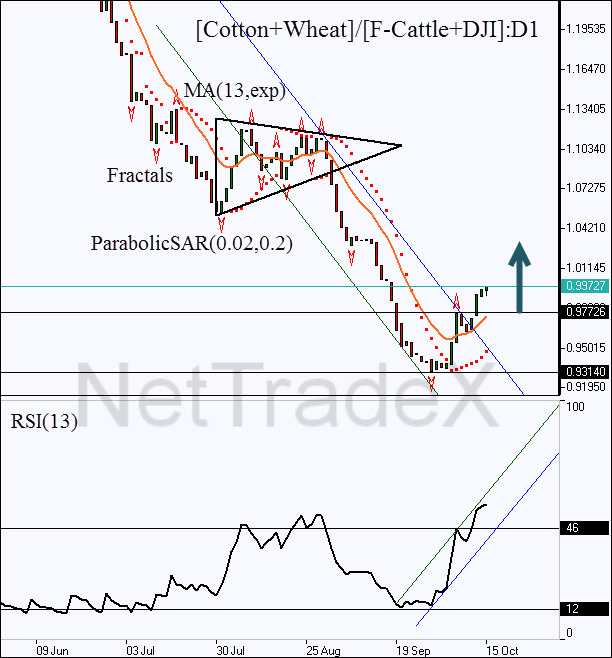

Let us examine main technical signals corresponding to the portfolio spread under consideration.

As can be seen from the chart below, the price broke the downtrend line: it may be considered as the first signal for price reversal. This significant signal was also marked by the breakout of strong resistance level at 0.97726, coinciding with the Bill Williams fractal. The price reversal was preceded by the important signal of RSI(13) leading oscillator. We can see that a bearish pattern “double bottom” was formed on the oscillator chart in late September. At the same time, a bullish signal was created by the ParabolicSAR trend indicator.

Currently, the oscillator confirms the uptrend. At the same time the price rose above the exponential moving average, indicating a steady growth. We deem that a buy position can be opened immediately with Stop Loss placed below 0.93140. This level coincides with the “double bottom” pattern, therefore, risk limitation at this level can be considered strong for the selected position. The price growth potential is several times greater than that of risks due to the historical oversold state of the instrument: the price moved slightly above (6.8%) the record low since 1995 (!). Consequently, the proposed position is highly profitable.

Note that instruments included in the base portfolio (Cotton, Wheat) are less oversold. The cotton price is 126% higher than the record low (61.68 vs. 27.30), while the wheat price – 280% (512.7 vs. 232.4). We can observe that the creation of a composite instrument permits having the necessary technical signals with higher efficiency.

After position opening, Stop Loss is to be moved after the Parabolic values, near the next fractal low. Updating is enough to be done every day after a new Bill Williams fractal formation (5 candlesticks). Thus, we are changing the probable profit/loss ratio to the breakeven point.

OLDER_GEVORKO_SECRETS

- Fourth basic tenet of Dow Theory: serving the investor

- Sharpe Portfolio | "The Three Leaders" - DJIA, S&P500, Nasdaq 100

- Portfolio Quoting Method for Analysis of "Good" and "Bad" Portfolios

- Portfolio Optimization through PQM Method (Part 2)

- Portfolio Optimization through PQM Method (Part 1)

- Stock Portfolio Construction | Stock Portfolio Analysis - Pportfolio Quoting Method PQM