- Education

- Forex Technical Analysis

- Technical Indicators

- Bill Williams Indicators

- Market Facilitation Index

Market Facilitation Index Indicator - Bill Williams MFI

How to Use MFI Indicator

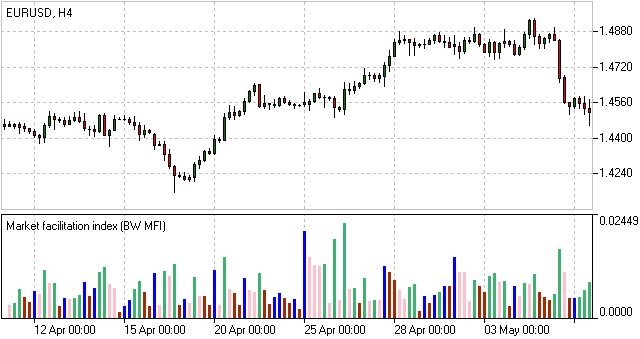

The absolute values of the Market Facilitation index are represented by the histogram's bars while the comparison of the index and volume dynamics are given in colors which are vital in terms of reading the indicator signs.

- Green bar - both MFI and volume are up. Increasing trading activity means market movement acceleration. We may join the trend.

- Blue bar - MFI indicator is up, volume is down. The movement is continuing although the volume has dropped. The trend will soon be reversing.

- Pink bar - MFI indicator is down, volume is up. The slowing down movement while volume is raising may indicate a possible break through, often a U-turn.

- Brown bar - both MFI and volume are down. The market is no longer interested in the current direction and is looking for signs of a future development.

Market Facilitation Index (BW MFI)

Market Facilitation Index Formula (Calculation)

The Market Facilitation index is calculated as the difference between the high and low bar prices divided by the volume for that period.

BW MFI = (HIGH-LOW)/VOLUME

How to use Market Facilitation Index Indicator in trading platform

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.

Use indicators after downloading one of the trading platforms, offered by IFC Markets.

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest