- Education

- About Forex

- Trading Systems

Trading Systems

There are numerous trading strategies that traders can employ to earn profit in forex markets and successful traders learn to identify profitable opportunities as they develop. Experience teaches which market conditions are more likely to result in successful trades and recognizing when to open and close positions and how to manage risks becomes a valuable knowledge.

Trading systems constitute explicit rules for executing trade deals that can be implemented as automated system without human involvement or semiautomated that require human input in the trading process. Thus trading systems are practical realizations of the knowledge when, how and what deals to open under various market conditions that traders develop to make the trading process structured and consistent.

KEY TAKEAWAYS

- Trading systems can be broadly classified into Mechanical trading systems and Discretionary trading systems.

- A discretionary trading system employs a mix of trading rules and trader’s experience to initiate deals and close positions.

- The main advantage of trading systems, which is also the main reason for their popularity, is elimination of human emotions or bias from trading.

What is Trading System

A forex trading system is a set of rules that guides the trader when and how to trade. Forex trading systems can be based on technical indicators or fundamental analysis or both of the above mentioned to initiate and implement trade deals.

Generally, using technical indicators as basis for forex trading systems is more straightforward as technical indicators are well defined and building rules for monitoring markets with the help of technical indicators is easier.

Classification of Trading Systems

Trading systems can be broadly classified into Mechanical trading systems and Discretionary trading systems.

A mechanical trading system is based on a set of explicitly defined rules. These rules employ either technical indicators or fundamental analysis to identify a buy or a sell opportunity, then trigger buy or sell orders and then close the position.

A buy or a sell trade is initiated when the trading conditions are met.

An example of straightforward and popular trading system is a moving average cross over trading system.

Moving Average Crossover trading strategy is a type of directional strategy. It is based on use of technical analysis indicators - two moving averages of differing numbers of periods - to generate buy or sell orders using crossovers of those two moving averages.

Moving averages are mainly used to identify presence of a trend in a market. While there are many practical methods for identifying presence of a trend, many define the trend in the stock market by using the 200-day moving average of the closing price. The direction of moving average is often used as indication of the prevailing trend over a period.

Simple moving average (SMA) is simply the mean, or average, of asset price values – usually closing prices, over the specified number of periods.

Below is the formula for SMA:

SMA= [A1 + A2 +...+ An] / n

where:

An = the price of an asset at period n

n = the number of total periods.

When charting two moving averages of differing numbers of periods, say price moving averages for 50 and 200 periods denoted as MA(50) and MA(200), the average of shorter term (relative to the other moving average) – the MA(50), will move in the same direction as the longer term moving average MA(200) - but at a higher rate. The different rates of change result in points where the values of the two moving averages may equal and or cross one another. These points are called the crossover points.

Consider Figure 1, the stock chart for IBM Inc. (NYSE: IBM). Here, the orange colored line is the 200-day moving average and the aqua colored line is the 50-day moving average.

Figure 1 – Example of a mechanical trading system based on moving averages crossover

A simple mechanical trading system can be developed using the set of rules determining when the stock is to be bought or sold. In this case a mechanical trading system would be buy on a bullish crossover and to either book profits after price moves a certain percentage or to exit after price moves a fixed amount.

Similarly, a mechanical trading system would be sell on a bearish crossover and to either book profits after price moves a certain percentage or to exit after price moves a fixed amount.

In the first instance, the shorter moving average SMA(50) crosses above the longer moving average SMA(200), known as the Golden cross. Following the bullish crossover of the 50 and 200 day SMAs, a long position is initiated.

In the second case, the shorter moving average SMA(50) crosses below the longer moving average SMA(200), known as the Death cross. Following the bearish crossover of the 50 and 200 day SMAs, a short position is initiated.

A mechanical trading system is the easiest to automate as there is not much of discretion involved.

Discretionary Trading System

A discretionary trading system employs a mix of trading rules and trader’s experience to initiate deals and close positions. Discretionary trading systems are relatively complex than just rule-based trading systems. However, they can be no less profitable than mechanical trading systems.

A straightforward example of a discretionary trading system could be one based on fundamentals. It can involve analyzing performance indicators from an earnings call and determining whether to act on underperformance or earnings beat or not. Combinations of financial indicators can be checked to verify certain performance scenarios are confirmed which then will call for initiating long or short positions if at all.

A discretionary trading system requires the assistance of a human and therefore it is more difficult to build one.

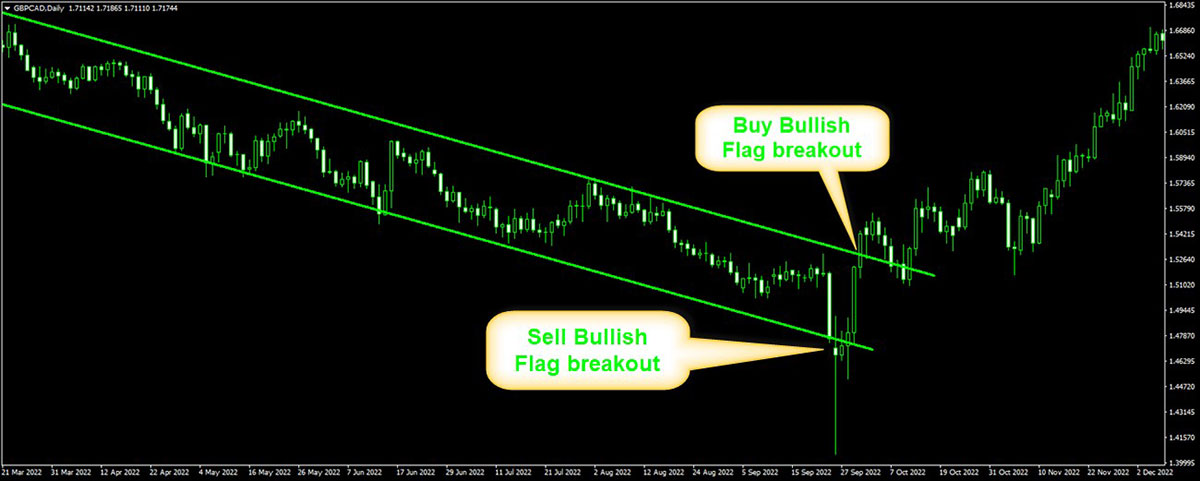

Look at the next chart below. In Figure 2, we have Bullish Flag chart pattern.

Figure 2: Bullish Flag chart pattern

Here a system should be coded that plots or identifies a Bullish Flag chart pattern. It is not that difficult in itself. But then what rules to use for trading Bullish Flag chart breakout patterns? Trader’s consideration can be essential in determining whether a breakout is to be traded or discarded. The only way one can hone his skills is by experience. Every time will be different as a trader will need to adjust his analysis accordingly.

One can also combine various macro-economic factors to determine what will be monetary policy-makers’ next decision and initiate trades based on their expected effect on a currency pair.

It can be difficult to code a discretionary trading system as the buy and sell rules can change from case to case. Thus, there is no uniformity involved and the success of using a discretionary trading system largely depends on the trader’s experience and familiarity with the system.

Advantages of Trading Systems

Various trading strategies can be automated to build mechanical or discretionary trading systems. As mentioned earlier, they differ in relative complexity and call for no or considerable human involvement in operation.

A mechanical trading system is good when:

- Rules are very clear and leave no room for discretion

- There is no need for human interference

- It can be easily coded or programmed

- It can be easily backtested to check the past performance of the trading system

- Traders can view the back testing and forward testing data to further fine tune the trading system

A discretionary trading system is preferable when:

- A significant amount of fundamentals are essential in determining and implementing a trading strategy

- A trader is manually trading and analyzing the charts

The main advantage of trading systems, which is also the main reason for their popularity, is elimination of human emotions or bias from trading.

Markets are in constant change and the inherent market uncertainty makes it very difficult to correctly predict market movements. Errors in market predictions may result in steep drawdown of trading account, making trading a stressful activity.

Desire for gain can make one forget rules for successful trading such as appropriate risk management and result in reckless trading such as Doubling down and over-leveraging.

Fear of missing out on market moves similarly can result in placing trades that would not have been determined worthy of execution under impartial consideration.

Setting explicit rules when to open positions and how to control risk and incorporating them in a trading system removes emotional involvement from trading.

Another advantage of trading systems is possibility of measuring system’s effectiveness by performing backtesting of strategies. Backtesting assesses the successfulness of a trading strategy by showing how it would play out using market historical data. Such trials reveal strategy effectiveness and provide some basis for consistent trading.

Bottom Line on Trading Systems

Systematic application of explicit rules for initiating trades makes trading systems a great tool for practical trading in financial markets. Trading systems reduce emotional involvement from trading and application of rules in determining what deals to initiate and how to implement them makes trading more consistent and efficient.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.